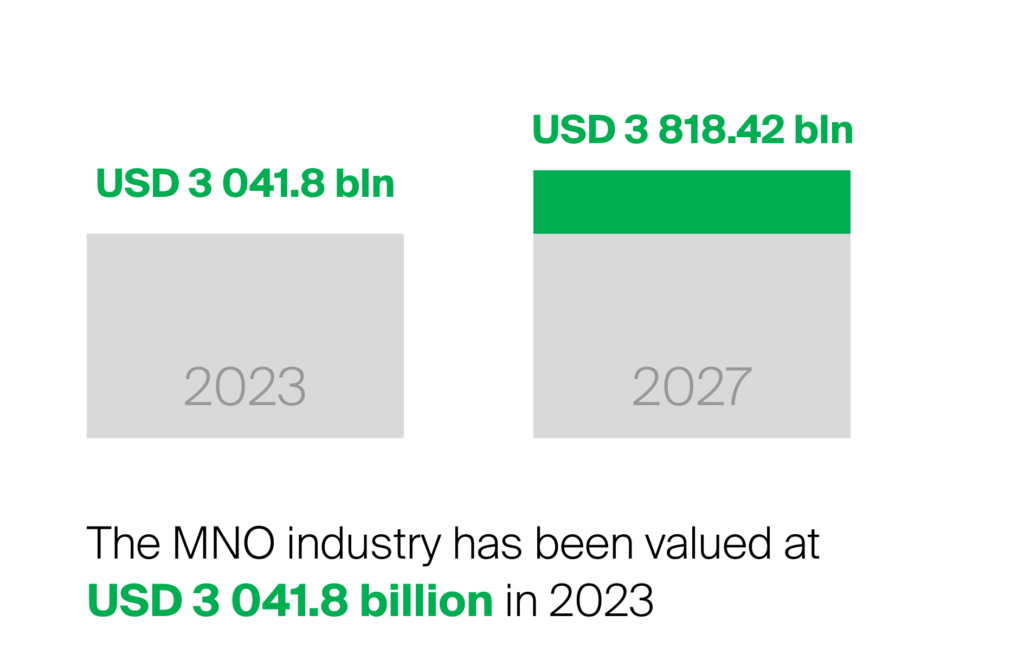

The Mobile Network Operator (MNO) industry, valued at $3041.8 billion in 2023, is constantly evolving and experiencing significant changes in technology, regulation, and customer demand. As we say goodbye to 2023, various trends, innovations, and challenges have impacted the industry, presenting opportunities and threats throughout the year. It is essential to recognise the lessons and challenges of this period.

Suggest reading: Four industry trends operators should look out for in 2023

In 2023, the global telecom market grew at a compound annual growth rate (CAGR) of 6.0%, expected to reach $3818.42 billion in 2027 at a CAGR of 5.8%. The industry has also made significant progress, with advanced technologies like 5G, AI, and ML transforming how Mobile Network Operators (MNOs) operate. However, these advancements have led to new challenges that MNOs must overcome by adapting their networks.

This article will examine the significant takeaways that emerged in the MNO Industry in 2023, including combatting fraud, adapting to the decreasing A2P SMS market and enhancing customer experience through Chatbots and Communication Platform as a Service (CPaaS) solutions. We will also explore GMS’s findings from the industry during this period and understand what MNOs could be able to implement.

Let’s delve into these key takeaways.

Key industry insights from 2023

As we reflect on the trends of 2023, there are three valuable messages that have significantly impacted the industry. These include finding new ways to solve problems, improving processes, and emphasising the importance of adapting to change.

1. Combatting Fraud in the Telco Industry

MNOs face a significant challenge in dealing with fraud, which remains a pressing concern. In 2023, some common types of fraud affecting MNOs were Artificial Traffic Inflation (AIT), voice fraud, and advance SMS scams. AIT is a type of fraud that involves generating artificial traffic to increase traffic volumes, leading to higher payouts from MNOs. Voice fraud, on the other hand, consists of using stolen or fake identities to make calls that generate revenue for the fraudster. Advance SMS scams typically involve sending subscribers fake or misleading text messages, encouraging them to respond and revealing sensitive information.

To mitigate these risks, MNOs must implement robust fraud detection and prevention mechanisms. This includes using boosted firewalls with AI technology to detect and monitor potential threats to the network and can help MNOs analyse large amounts of data, identify patterns of fraudulent behaviour, and prevent fraudulent activity before it occurs, which will help operators stay ahead of fraudsters and safeguard their revenues.

2. Adapting to the decline in the A2P SMS Market

Alternative messaging platforms such as WhatsApp, Viber, and Telegram have gained immense popularity, leading to a decline in the A2P SMS market. To stay competitive, MNOs have started to adapt and look for ways to diversifying their revenue streams and exploring new business opportunities. One way to achieve this is by leveraging technologies such as Rich Communication Services (RCS) and Over-The-Top (OTT) messaging platforms.

RCS is a messaging protocol that enables MNOs to offer enhanced messaging services such as read receipts, group chat, and multimedia messaging. However, OTT messaging platforms provide messaging services on a real-time basis using internet connectivity to communicate. By acknowledging the popularity of these alternatives, MNOs can continue to provide value-added services to their customers while meeting their evolving communication needs.

3. Enhancing Customer Experience with AI Chatbots and CPaaS

Providing a good customer experience service can be a key differentiator for MNOs. In 2023, we saw an increased adoption of AI Chatbots and Communication Platform as a Service (CPaaS) solutions among MNOs.

By leveraging natural language understanding (NLU), machine learning, and other advanced technologies, AI-powered chatbots can quickly and accurately answer even complex customer queries. This helps reduce response times and enhance customer satisfaction while reducing overall customer care costs by up to 30%. Moreover, AI chatbots can be available 24/7, providing customers with round-the-clock assistance. Similarly, CPaaS solutions have become increasingly popular among MNOs. CPaaS enables MNOs to offer innovative communication channels, such as messaging APIs, and embrace conversational strategies.

With those alternatives in place, MNOs can provide customers with a seamless omnichannel experience across all touchpoints and effectively engage them through their preferred channel. Moreover, the growing enterprise demand for AI Chatbots and CPaaS solutions makes them a great opportunity for MNOs to diversify their revenue streams. They can consider adding these solutions to their B2B portfolio through white-label partnerships and offering them to their enterprise customers as a communication innovation.

4. Takeaways GMS has gathered in 2023

Throughout the year, the industry has taught us four key lessons. Firstly, A2P traffic has become more diverse, providing a wide range of channels to deliver messages to end customers. One such channel gaining popularity is the Rich Communication Services (RCS), an advanced messaging protocol offering features such as read receipts, typing indicators, and the ability to send multimedia content. As of 2023, Google’s Cloud platform had over 800 million active RCS users, which is a witness to the growing popularity of this messaging technology. Moreover, the technology is supported by more than 1.2 billion handsets worldwide, making it accessible to a vast majority of mobile users. This increased adoption of RCS is due to its ability to provide users with a more engaging and interactive messaging experience. With its advanced features, RCS helps businesses enhance their customer engagement and strengthen their brand image.

Secondly, with the recent surge in rates for A2P SMS, enterprises are now demanding more flexibility and options from MNOs, what caused a significant impact on businesses that rely on this service. To address this challenge, MNOs are exploring various options, such as mobile advertising, data analytics, Internet of Things (IoT) connectivity, and other digital services that can add value to their customers while generating additional revenue streams. Thirdly, the emergence of artificially inflated traffic (AIT) has become a critical issue for both operators and enterprises. With the increasing traffic volume of AIT in various business operations, there is a need to find mechanisms that control it and address the potential risks associated, such as data privacy concerns and security risks.

Finally, MNOs must prioritise providing stable and secure service delivery to subscribers, even if this does not generate immediate income, considering that the market rewards the best service providers who prioritise customer protection and fulfil subscribers’ needs. By taking note of these four key takeaways from the MNO industry, GMS highlights the importance of innovation, flexibility, and customer-centricity for network operators and businesses.

Looking ahead

To sum up, the MNO industry has experienced key takeaways in 2023. Operators have faced challenges such as combating fraud, adapting to the decline in the A2P SMS market, and the need to enhance further the customer experience.

Suggest reading: Key Trends and Threats Shaping the Mobile Market in 2024

Therefore, by implementing robust fraud detection and prevention mechanisms, diversifying revenue streams, and leveraging technologies such as Chatbots and CPaaS solutions, MNOs can continue to offer innovative services to their customers and stay competitive. If you want to learn more about the solutions available to protect MNOs from SMS fraud or boost your network with new revenue streams, don’t hesitate to contact our experts today. It will be exciting to see how the industry adapts to the changing landscape in the years to come.